The Vanguard Total Stock Market ETF (VTI) is pitched as broad exposure to the entire U.S. equity market. The headline? Up 13% year-to-date. But before you pour one out for diversification, let’s dissect what "total" really means in this case.

VTI currently holds 3,488 stocks. Sounds impressive, right? But the top five holdings—Nvidia (NVDA), Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), and Broadcom (AVGO)—constitute a disproportionate chunk of the fund. A whopping, I'd say. Nvidia alone accounts for 7.14%. Apple, 6.12%. Microsoft, nearly 6%. That's almost 20% tied to three tech giants. The fund is being pulled by a small number of stocks.

This isn't unique to VTI; it's a characteristic of market-cap-weighted indexes. But it's crucial to understand that “total market” doesn’t equate to equal weighting. The performance of a few behemoths can easily overshadow the collective movements of the thousands of smaller companies in the fund. Is that really the diversification you thought you were buying?

Consider Caterpillar (CAT), a Dow stock that has crushed both VOO (the S&P 500 ETF) and VTI this year, up over 56%. While VTI holds it, its impact is diluted by the sheer number of other holdings. These Dow Stocks Have Crushed the VOO and VTI in 2025—Here’s Where They’re Headed Next Goldman Sachs (GS), another Dow standout, is up over 36% year-to-date. Again, a blip in VTI's overall performance.

The problem here is one of perception versus reality. Investors see "total market" and assume their risk is spread evenly. It isn't.

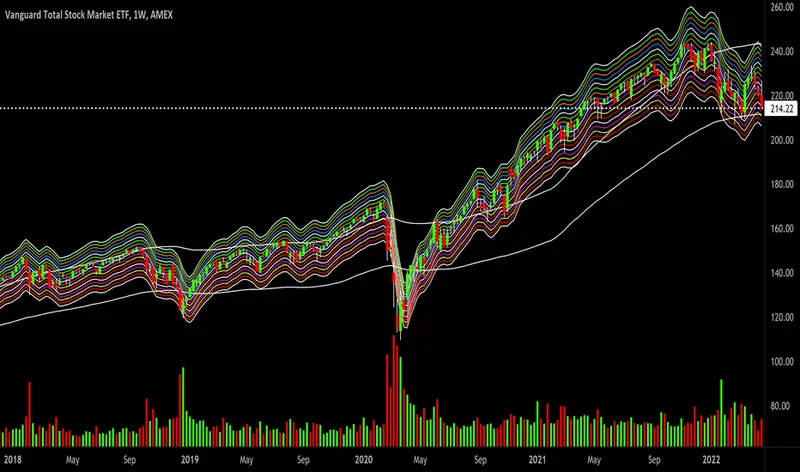

TipRanks Technical Analysis gives VTI a "Neutral" rating overall, but a "Sell" based on moving average consensus. The ETF is trading at $323.80, below its 50-day exponential moving average of $327.30 (a sell signal). I've seen this pattern before. It suggests short-term momentum is waning, even if the year-to-date numbers look rosy.

Analyst sentiment, however, paints a different picture. TipRanks' ETF analyst consensus rates VTI as a "Moderate Buy," with an average price target of $392.91, implying a 21.3% upside. This is based on a weighted average of analyst ratings on VTI's holdings. But remember, those holdings are not equally weighted! The analysts might be bullish on the potential of smaller companies within VTI, but their impact on the ETF's overall performance will be limited unless those companies experience explosive growth.

And this is the part of the report that I find genuinely puzzling. The disconnect between the technical sell signal and the moderate buy rating. Which signal do you believe?

Speaking of individual holdings, TipRanks highlights stocks with the highest upside potential within VTI: FAT Brands (FAT), Jupiter Neurosciences (JUNS), Cibus (CBUS), NRX Pharmaceuticals (NRXP), and Direct Digital Holdings (DRCT). Conversely, they list LXP Industrial Trust (LXP), Dillard’s (DDS), Hertz Global (HTZ), and Opendoor Technologies (OPEN) as having the greatest downside potential. What's the takeaway? VTI isn’t a monolithic block. It’s a collection of individual bets, some of which are likely to pay off, and some of which are not.

VTI's Smart Score is seven, implying it will perform in line with the broader market. A fairly useless statement.

What’s missing here? A clear breakdown of how much each sector contributes to VTI's overall performance. Tech is obviously dominant, but what about financials? Healthcare? Consumer staples? Without that granular data, it's impossible to make an informed judgment about whether VTI aligns with your specific investment goals and risk tolerance.

VTI offers broad exposure, yes, but it's heavily influenced by a handful of tech giants. The "total market" narrative is, to some extent, a mirage. Investors need to understand the ETF's underlying composition and the disproportionate impact of its top holdings. Otherwise, they might be surprised when their "diversified" portfolio moves in lockstep with the FAANG stocks.

And this is why I write these analyses. To make sure you know what you actually own.